Getting The Feie Calculator To Work

Wiki Article

All About Feie Calculator

Table of ContentsFeie Calculator Can Be Fun For Everyone10 Easy Facts About Feie Calculator ShownFeie Calculator Things To Know Before You Buy4 Easy Facts About Feie Calculator DescribedSome Ideas on Feie Calculator You Should KnowThe Ultimate Guide To Feie CalculatorThe 5-Minute Rule for Feie Calculator

If he 'd often traveled, he would instead finish Component III, listing the 12-month period he met the Physical Visibility Test and his travel background. Step 3: Reporting Foreign Income (Component IV): Mark earned 4,500 per month (54,000 every year).Mark computes the exchange rate (e.g., 1 EUR = 1.10 USD) and converts his salary (54,000 1.10 = $59,400). Given that he lived in Germany all year, the percentage of time he stayed abroad during the tax obligation is 100% and he goes into $59,400 as his FEIE. Finally, Mark reports overall wages on his Form 1040 and goes into the FEIE as a negative quantity on time 1, Line 8d, reducing his taxed revenue.

Choosing the FEIE when it's not the finest alternative: The FEIE may not be suitable if you have a high unearned earnings, earn greater than the exclusion limit, or live in a high-tax country where the Foreign Tax Credit Report (FTC) may be extra useful. The Foreign Tax Obligation Debt (FTC) is a tax obligation decrease approach frequently used combined with the FEIE.

3 Simple Techniques For Feie Calculator

expats to counter their U.S. tax obligation debt with foreign earnings tax obligations paid on a dollar-for-dollar decrease basis. This means that in high-tax countries, the FTC can typically get rid of U.S. tax obligation financial obligation entirely. Nonetheless, the FTC has limitations on qualified tax obligations and the optimum case quantity: Qualified tax obligations: Only income tax obligations (or taxes instead of earnings taxes) paid to international governments are qualified.tax obligation obligation on your international revenue. If the foreign tax obligations you paid surpass this restriction, the excess international tax can generally be continued for up to ten years or returned one year (using a modified return). Keeping accurate records of international income and tax obligations paid is therefore essential to determining the appropriate FTC and keeping tax conformity.

expatriates to reduce their tax responsibilities. If a United state taxpayer has $250,000 in foreign-earned earnings, they can omit up to $130,000 using the FEIE (2025 ). The continuing to be $120,000 might after that go through taxation, but the united state taxpayer can potentially use the Foreign Tax Credit rating to offset the taxes paid to the foreign country.

8 Simple Techniques For Feie Calculator

He sold his U.S. home to establish his intent to live abroad permanently and applied for a Mexican residency visa with his wife to help fulfill the Bona Fide Residency Test. Neil aims out that buying residential or commercial property abroad can be testing without first experiencing the place."It's something that individuals require to be actually attentive about," he states, and suggests expats to be mindful of common errors, such as overstaying in the United state

Neil is careful to stress to Anxiety tax authorities that "I'm not conducting any carrying out any kind of Service. The U.S. is one of the few nations that tax obligations its residents no matter of where they live, implying that also if an expat has no income from United state

8 Simple Techniques For Feie Calculator

tax returnTax obligation "The Foreign Tax obligation Credit report enables people functioning in high-tax nations like the UK to counter their U.S. tax obligation by the amount they have actually currently paid in tax obligations abroad," states Lewis.The prospect of reduced living expenses can be appealing, yet it frequently includes trade-offs that aren't instantly noticeable - https://share.evernote.com/note/9e125a91-594e-2660-7748-d592c8d4508a. Housing, for example, can be a lot more budget-friendly in some countries, but this can mean jeopardizing on facilities, safety, or accessibility to trusted utilities and solutions. Cost-effective properties may be found in locations with inconsistent internet, minimal public transport, or unstable medical care facilitiesfactors that can substantially influence your daily life

Below are some of one of the most frequently asked inquiries concerning the FEIE and other exemptions The International Earned Revenue Exclusion (FEIE) allows U.S. taxpayers to leave out up to $130,000 of foreign-earned income from government income tax, lowering their U.S. tax obligation obligation. To get approved for FEIE, you need to meet either the more Physical Visibility Test (330 days abroad) or the Authentic Residence Test (confirm your key residence in a foreign nation for a whole tax obligation year).

The Physical Existence Test needs you to be outside the U.S. for 330 days within a 12-month duration. The Physical Presence Examination also calls for U.S. taxpayers to have both a foreign earnings and an international tax obligation home. A tax home is defined as your prime place for business or work, no matter your household's house. https://243453048.hs-sites-na2.com/blog/feiecalcu.

What Does Feie Calculator Do?

A revenue tax obligation treaty between the U.S. and another country can help stop dual tax. While the Foreign Earned Income Exclusion minimizes gross income, a treaty may offer fringe benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Report) is a required declare U.S. people with over $10,000 in international economic accounts.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation expert on the Harness system and the owner of The Tax obligation Dude. He has over thirty years of experience and currently specializes in CFO solutions, equity settlement, copyright taxes, cannabis taxation and separation relevant tax/financial preparation issues. He is an expat based in Mexico.

The foreign made revenue exemptions, sometimes referred to as the Sec. 911 exemptions, omit tax obligation on salaries earned from functioning abroad.

The 2-Minute Rule for Feie Calculator

The tax benefit excludes the earnings from tax obligation at lower tax obligation rates. Previously, the exemptions "came off the top" lowering revenue subject to tax obligation at the leading tax obligation prices.These exemptions do not excuse the wages from US taxation but simply give a tax obligation decrease. Note that a bachelor working abroad for every one of 2025 that gained regarding $145,000 without various other revenue will certainly have gross income reduced to absolutely no - successfully the same response as being "tax complimentary." The exclusions are computed each day.

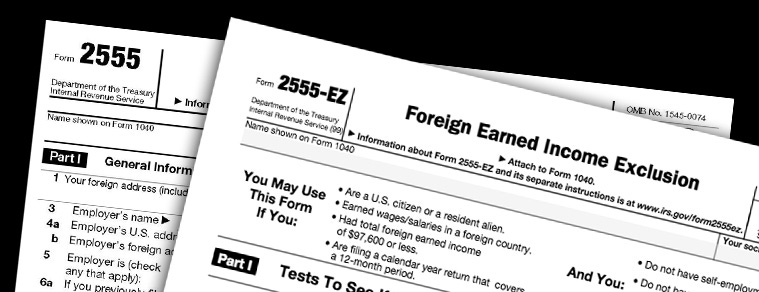

If you went to company meetings or workshops in the US while living abroad, revenue for those days can not be omitted. Your earnings can be paid in the US or abroad. Your employer's area or the area where salaries are paid are not consider receiving the exemptions. Form 2555. No. For United States tax obligation it does not matter where you maintain your funds - you are taxable on your globally income as a United States individual.

Report this wiki page